The proprietor can charge interest on the amount invested by him/her in the business as capital, which is shown as Interest on Capital. Interest on Capital Journal Entry recognises the interest expense incurred by the partnership for using the partner’s capital. Interest on Capital A/c (Expense) is debited in this case and Capital A/c of the respective partner is credited (increased) by the interest amount. The interest expense is then distributed among the partners according to their profit-sharing ratios.

Interest on Capital Journal Entry

Example 1: Interest is charged ₹800 on capital.

Solution:

Journal Entry

Example 2:

- Started business with Cash ₹1,00,000.

- Charged Interest on Capital @6% per annum.

Solution:

Journal Entry

1. Life Insurance Premium:

Sometimes, Life Insurance Premium is paid by the business on the behalf of the proprietor. Life Insurance Premium of the proprietor is considered to be a personal expense of the proprietor and hence is treated as Drawings by the business.

Journal Entry:

Example: Life Insurance Premium is paid ₹5,000.

Solution:

2. Employee’s Life Insurance Premium:

Businesses purchase life insurance for their employees too. Unlike the Life Insurance Premium of the proprietor, any payment made on purchasing Employee’s Life Insurance is not considered a personal expense rather it is treated as a business expense.

Journal Entry:

Example: Employee’s Life Insurance Premium is paid ₹10,000.

Solution:

The amount withdrawn from the capital by the proprietor for personal use is called drawings. Businesses can charge interest on the amount of drawings.

Journal Entry:

Example 1: Interest is charged on drawings ₹500.

Solution:

Example 2:

- Withdrawn cash from the business for personal use ₹5,000.

- Interest charged on Drawings @6%.

Solution:

Sometimes goods of a business are used in the business itself. If this happens, those goods are considered assets by the business.

Journal Entry:

Example 1: A electrical goods dealer uses fans for the business worth ₹1,000.

Solution:

Example 2: A furniture merchant uses furniture for the business worth ₹5,000.

Solution:

Any expenditure incurred in the erection or installation of any building or machinery or any type of asset is considered to be capital expenditure and debited under the name of the particular asset.

Journal Entry:

Example 1: Machinery purchased worth ₹50,000 and paid installation charges ₹2,000.

Solution:

Example 2: Purchased building for ₹5,00,000 and paid ₹25,000 on its registration.

Solution:

Purchasing process involves a number of steps starting from placing an order and ending with the delivery of goods. Apart from the cost incurred in purchasing the goods, any additional expenses like Carriage, Import Duty, etc is also paid. Any expenses incurred during the purchase of goods will be shown separately unlike an expenditure on assets.

Journal Entry:

Example 1: Goods purchased worth ₹10,000 and carriage paid ₹500 on it.

Solution:

Example 2: Goods purchased worth ₹50,000 and paid for import duty ₹1,250.

Solution:

The Goods and Services Tax or GST is a single, indirect tax that integrates all indirect taxes within the Indian economy. GST is a destination-based consumption tax as it is charged at every stage, wherever some value is added to the goods or services, and the supplier of the good or service offsets the charge on its inputs of the previous stages. The charge is offset through the tax credit mechanism. Ultimately, the last dealer passes on the added GST to the consumer of the goods or services.

The three types of taxes under GST are:

- Central Goods and Services Tax (CGST): GST levied by the Centre on the Intra-State supply of goods or services i.e supply of goods and services in the same state.

- State Goods and Services Tax (SGST): GST levied by the State (including Union Territories with legislatures) on the Intra-State supply (supply of goods and services in the same state) of goods or services by the State.

- Integrated Goods and Services Tax (IGST): GST collected by the Centre and levied on the Inter-State supply of goods or services. In other terms, IGST is the total of CGST and SGST.

Classification of GST for Accounting Purposes:

1. Input CGST/SGST: Input CGST/SGST is paid on intra-state purchases of goods and services and adjusted against Output CGST/SGST i.e. GST collected on sales.

2. Input IGST: Input IGST is paid on inter-state purchases of goods and services and adjusted against Output IGST i.e. GST collected on sales.

3. Output CGST/SGST: Output CGST/SGST is collected on intra-state sales or supply of goods and services.

4. Output IGST: Input IGST is collected on inter-state sales or supply of goods and services.

Order of setting off of Input GST:

Journal Entries (In case of Intra-state supply of goods and services i.e. sales within the same state):

1. For purchase of goods:

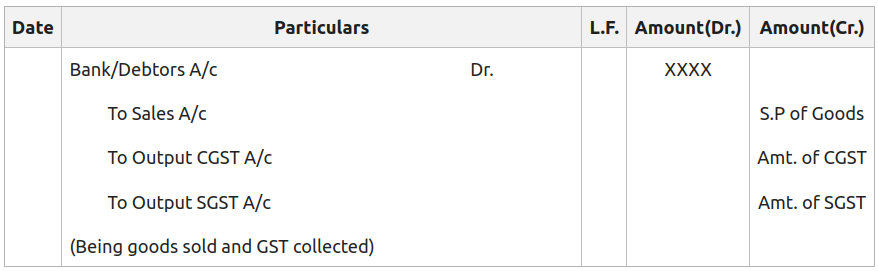

2. For sale of goods:

3. For purchase return:

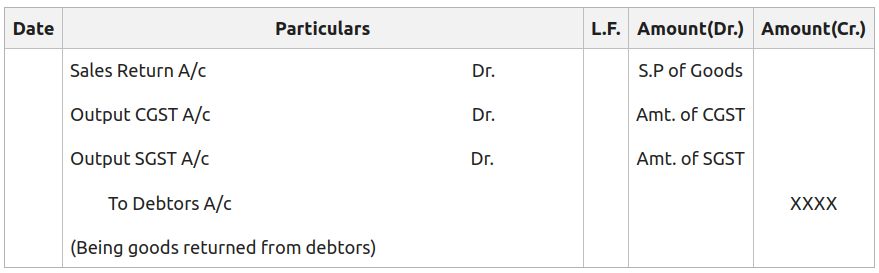

4. For sales return:

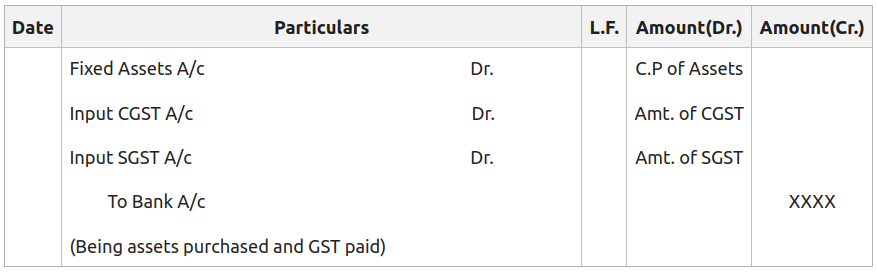

5. For purchase of fixed assets:

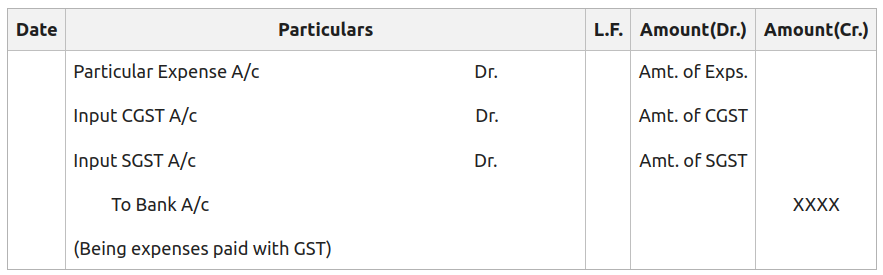

6. For expenses paid:

7. For income received:

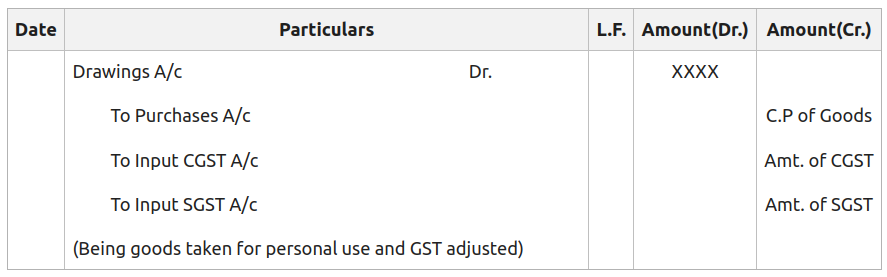

8. For goods withdrawn by the proprietor for personal use:

9. For goods given away as free samples/loss of goods by fire/theft:

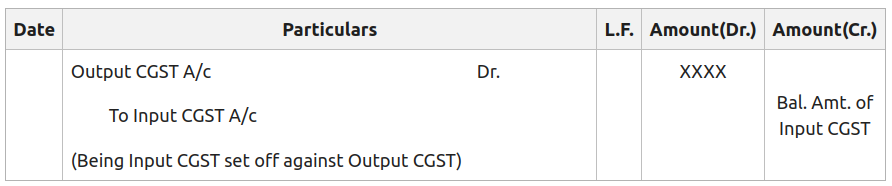

10. For setting off Input CGST against Output CGST:

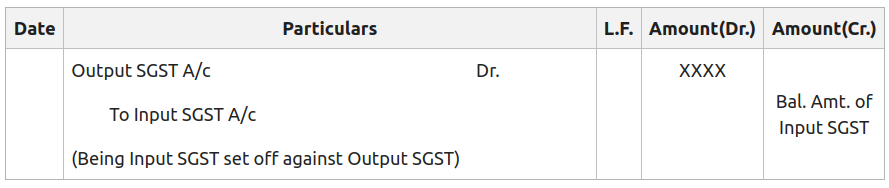

11. For setting off Input SGST against Output SGST:

12. For payment of GST:

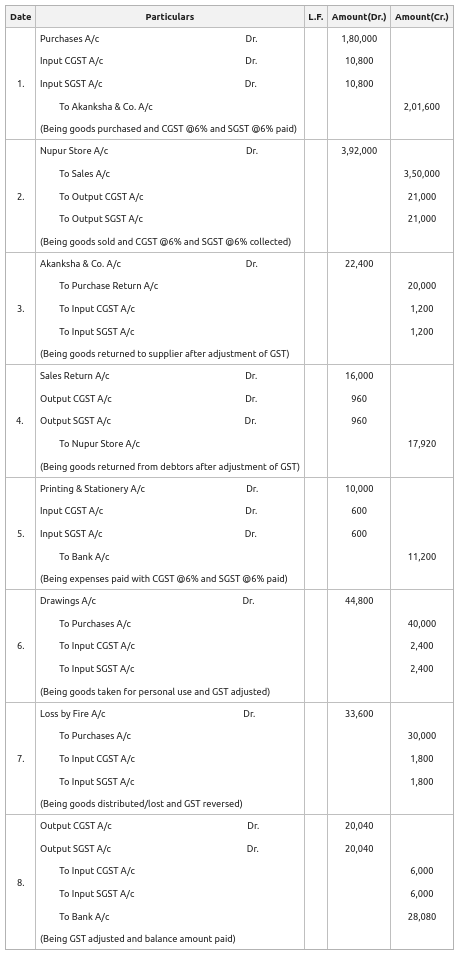

Illustration:

Pass journal entries for the following transactions in the books of Sahil Ltd. assuming that both parties belong to the same state and CGST @6% and SGST @6% are levied:

1. Purchased goods for ₹1,80,000 from Akanksha & Co.

2. Sold goods for ₹3,50,000 to Nupur Store.

3. Returned goods to Akanksha & Co. for ₹20,000.

4. Nupur Store returned goods for ₹16,000.

5. Paid for Printing and Stationary ₹10,000.

6. Goods withdrawn by the proprietor for personal use ₹40,000.

7. Goods destroyed by fire ₹30,000.

8. Payment made of balance of GST.

Solution:

Working Note:

Total Input CGST = 10,800 – 1,200 + 600 – 1,200 -900 = ₹6,000

Total Input SGST = 10,800 – 1,200 + 600 – 1,200 -900 = ₹6,000

Total Input CGST = 21,000 – 960 = ₹20,040

Total Input SGST = 21,000 – 960 = ₹20,040

Net CGST Paid = 20,040 – 6,000 = 14,040

Net SGST Paid = 20,040 – 6,000 = 14,040

Journal Entries (In case of Inter-state supply of goods and services i.e. sales from one state to another state):

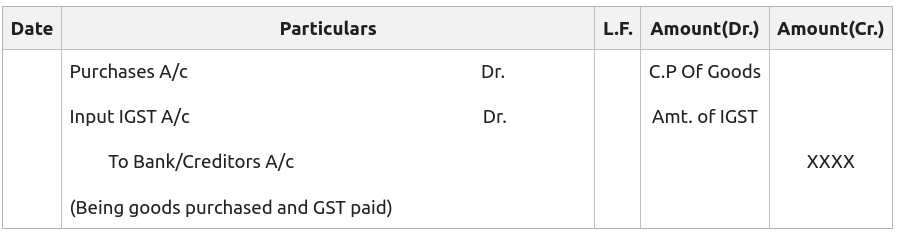

1. For purchase of goods:

2. For sale of goods:

3. For purchase return:

4. For sales return:

5. For purchase of fixed assets:

6. For expenses paid:

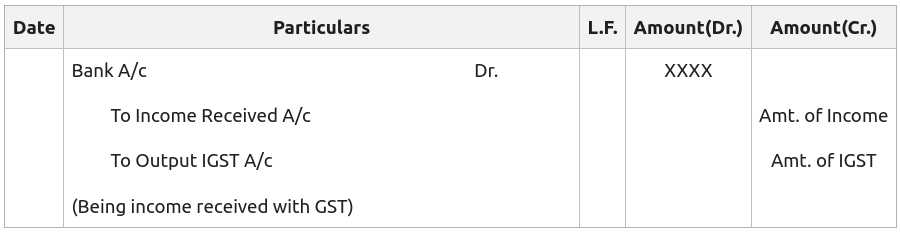

7. For income received:

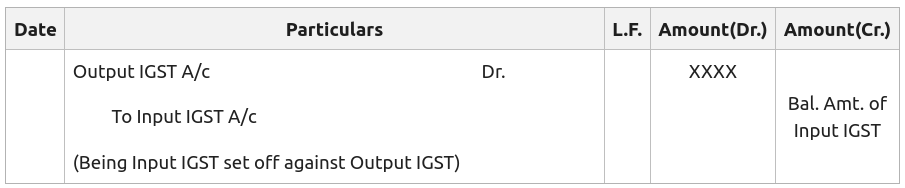

8. For setting off Input IGST against Output IGST:

9. If Input IGST exceeds the Output IGST, Input IGST will be first adjusted against CGST, and the balance, if any, will be adjusted against setting off SGST.

Illustration:

Pass journal entries for the following transactions in the books of Sahil Ltd. of Noida, Uttar Pradesh assuming CGST @6% and SGST @6% are levied:

1. Purchased goods for ₹6,00,000 from Sayeba & Co. of Patna, Bihar.

2. Purchased goods for ₹1,00,000 from Gaurav Store of Varanasi, Uttar Pradesh.

3. Sold goods costing ₹1,60,000 to Ishika of Ranchi, Jharkhand at a profit of 25% on cost less 10% Trade Discount.

4. Sold goods costing ₹5,00,000 to Shubham of Allahabad, Uttar Pradesh at a profit of 60% on cost less 15% Trade Discount against cheque which was deposited into the bank.

5. Paid for Advertisement ₹16,000.

6. Purchased a computer for office use for ₹60,000 and payment was made by cheque.

7. Proprietor withdrew ₹20,000 for his personal use.

8. Payment made of the balance amount of GST.

Solution: